By Susan Hillman, Treasury Alliance Group LLC

Tax, interest and regulatory considerations are key parts of most liquidity management implementations.

Part two of two

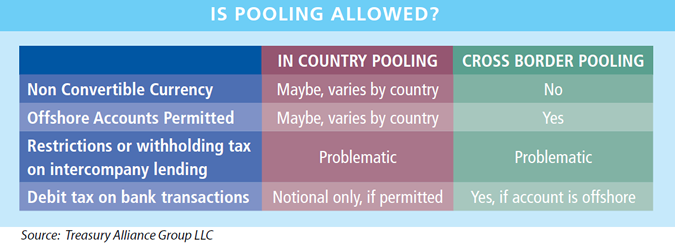

In Part One, the basics of pooling—both notional and physical—were discussed. Part Two digs a bit deeper into the tax, regulatory and related considerations involved in setting up cash pooling, some of which, were raised already. The appropriate pooling structure can only be determined after thinking through all practical and jurisdictional issues that may arise.

Key Considerations

In evaluating pooling arrangements, consider the following questions:

- What about tax? As alluded to in Part One, it is essential for firms to structure and document their cash pools in order to avoid any appearance of commingling of funds or deemed dividends, which may be subject to the interpretation of local tax authorities in each jurisdiction involved in the pool.

Notional pooling requires cross guarantees, but with physical pooling, the nature of the underlying transactions are clearly defined as intercompany loans. Thus, this cleaner and more transparent treatment can be preferable from a tax perspective. But as with all intercompany loans, documentation of arm’s length interest is essential.

- Interest calculations? On a monthly, quarterly, or annual basis, the interest income and expense will need to be calculated and allocated to the subsidiaries. Most companies with simple transaction flows use a spreadsheet to track the loans and interest. This activity takes a few minutes a day and a couple of hours at month end.

A treasury management system (TMS) can be used for those multinationals with complex flows and/or multiple

participants.For tax reporting purposes, the interest statement is provided to the subsidiaries—usually a standard report that can be generated from the ERP system. Alternately, a third party TMS application or the ERP’s treasury module can be used.

- What type of interest? This underscores the importance of the definition of interest as a key determination of tax treatment. The type of interest will affect the allocation back to the participants and the taxation levied on them in their own tax jurisdiction. For most companies operating a physical pool, the main account holder acts as an agent so, when the transactions are set up as intercompany loans, the interest is treated as bank interest which does not attract withholding tax.

Rates paid/charged will be based on LIBOR or EONIA—which is a standard benchmark rate. Whatever strategy is selected for cash pooling, both local and corporate tax counsel need to review and sign off on the arrangement.

- What’s the intercompany loan arrangement? The structure of the intercompany loan agreements in a cash pool is fairly straightforward. The company can elaborate or enhance its basic intercompany loan agreement to meet specific internal requirements, including notes or caveats that the loans are ‘payable on demand’ or any such language that provides both the corporate parent and the business operations with a level of comfort.

However, most companies choose to make the language and documentation as simple and straightforward as possible—particularly because the relationships are intercompany and not between third parties.

- Who owns the main account? Another consideration in setting up the arrangements is the designation/role of the Main Account Holder. Will the main account holder be acting as the principal for the group or as an agent on behalf of the participants?

- Is the region ripe for cross-border pooling? Europe is the most common region for cross-border pooling primarily because of the single currency across multiple countries. Also the large global banks have the branch networks to handle both in-country transactions and the centralized back-office operations for seamless pooling, especially within the eurozone. Consequently physical pooling is most often used in this region.

There are also virtually no regulatory restrictions, although some countries, e.g., Belgium, require that the participating local subsidiary be a net contributor to the pool. (This also applies to a US entity participating in a EUR pool; they cannot be in a deficit cash position.)

- What about excess funds? If the company has excess funds over and above what is required for subsidiary working capital needs, treasury must determine how to invest them and for what duration. Often pool investments are characterized as medium term for durations ranging from 90 days to six months, or potentially up to one year.

Pool-related investments can be made by the Holding Company and handled through the pool bank, another financial institution, or whatever investment approach is deemed suitable under the company’s investment guidelines.

As these funds are still assets owned by the contributing subsidiaries, it makes sense that there be some type of clause/agreement in the intercompany loan documentation that allows treasury to invest these funds for the expected tenors. The tenor of a cash pooling arrangement is critical. For excess or deficit cash positions longer than one year—whether the company uses notional or physical pooling—it is advisable to create separate long term loan agreements with the participating subsidiaries in order to invest the funds on a group basis, or to finance the cash-poor subsidiaries using direct lending or cash infusion. This would most likely satisfy tax authorities.

Companies who have pooling arrangements—either physical or notional—have them in place as a temporary arrangement for the smoothing of excess/deficit positions among related companies. Loans and/or cross guarantees are put in place to protect participating subsidiaries and to mitigate risk.

Pooling is not a quick fix or a top-down solution for managing widely varying cash positions. Nor is it a way to earn interest on blocked cash in highly regulated countries or to escape withholding tax that may arise from intercompany lending. Pooling can certainly be an overlay—but the decision to set up the arrangement should come as a result of a review of banking needs and account structures—on a country, regional or global basis—and from an assessment of the overall corporate liquidity situation.

|

ASK YOURSELF THIS… |

|

| Physical location of the entity that will hold the pool header accounts |

|

| Country where the pool header accounts are domiciled |

|

| Physical location of each business’ operational bank accounts |

|

| Interest earned or paid by the pool header accounts |

|

| Interest earned or paid by the account holders |

|

| Interest allocation methodology |

|

Susan Hillman is a Partner at Treasury Alliance Group LLC. She can be reached at: +847-295-6414, or [email protected]