McKinsey: Smart decisions transaction banks need to make to capture continuing growth.

From a corporate banking perspective, transaction banking has become a desired focal point and capital friendly contributor to bank returns.

From a corporate banking perspective, transaction banking has become a desired focal point and capital friendly contributor to bank returns.

And it’s no wonder: transaction banking enjoys twice the returns on a risk-weighted-assets basis than does corporate banking generally, coming in at 5.3 percent vs. 2.3 percent, according to research by McKinsey & Company. McKinsey’s research also notes that transaction banking creates stickiness of 29 percent to the length of a client business. That means a client relationship with transaction banking business lasts on average 9 years, vs. just 7 years for a credit-only relationship. What’s more, transaction banking contributes about 40 percent of overall corporate banking revenues and is expected to grow to closer to 50 percent by 2018, or roughly 10 percent average growth increased per year. This is true across all regions, except for the Americas, where McKinsey expects it to fall from 36 percent to 33 percent. In revenue terms, transaction banking is expected to reach EUR225bn in EMEA by 2018, from EUR152bn, EUR519bn in Asia, from EUR295bn, and EUR202bn in the Americas, from EUR134bn.

Still, despite all the gaudy numbers, transaction banks will need smart answers to overcome the key challenges facing the business. Overcoming these challenges will help them stay ahead of this growth story and make good on strategic commitments by transaction banking leaders.

Key challenges

McKinsey identifies five key challenges:

- The general profitability squeeze and declining margins created by the on-going low interest rate environment.

- Increasingly sophisticated customers looking for better integrated and tailored solutions

- Increasing regulation on financial risk and non-financial operational risks (including KYC related compliance requirements).

- Speedy technological innovation, including digitalization efforts along the value chain.

- New standards and technology-driven innovation with shift to more interoperable, multibank market.

Because of these five challenges, McKinsey suggests that “smart answers” by transaction banks are required to succeed going forward.

Smart answers

The five “smart answers” to the above challenges that McKinsey cited are:

- Finding new cooperation and partnership models to avoid internal complexity costs and capture a higher “share of the pie”

- Smartly investing in digitizing the transaction banking value chain with a focus on elements with the highest benefits/payoff

- Optimizing products leveraging new standards (e.g., 3SKey, eBAM) and positioning in large-scale platform business, in particular regarding emerging trade finance models (e.g., BPO, SCF solutions)

- Pushing a new paradigm of sales by taking a true CFO-angle and fighting the battle for margin by optimizing pricing at the client/product level with analytical state-of-the-art tools

- Launching “next-wave” of lean and automated, and exploring options to outsource/share non-critical processes.

New ways of cooperating

One smart answer McKinsey emphasized in its SIBOS presentation was the need to replace traditional correspondent banking arrangements (which tend to be basic bilateral agreements focused on reciprocal domestic services and with limited platform integration) with new cooperation and partnership models.

New cooperation and partnership models need to help banks deepen client relationships and allow new client acquisition without client portfolio churn. They should also optimize product and service lines with expanded offerings, greater differentiation and better profitability than what any one bank might offer on its own. Given the risks emphasized by current regulation, these models must also be more selective regarding partners. Finally, these partnerships should broaden the networks and expand the scale for transaction banks, with a focus on building market positions in key countries and increase overall volume of the combined platforms.

According to McKinsey, these new partnerships will likely take four different forms:

- Regional-to-local agreements: regional leaders partnering with local champions in clearly defined markets.

- Inter-regional agreements: regional leaders entering “deep” and “peer-to-peer” partnerships in complementary regions (e.g., a strong Asia player with a transaction bank strong in Europe), typically with “light integration” of systems and processes.

- Regional supra-agreements: Global powerhouses partnering with a regional leader or multiple local champions in a region non yet covered by a standardized “supra-agreement” with deep technical integration.

- White labeling: Global powerhouse/regional leader providing specific product capabilities to a local champion.

Better digitalization

The second area of focus in McKinsey’s SIBOS presentation was the need for better digitalization in transaction banking. One of the main reasons transaction banks have done a relatively poor job of investing in digitalization is due to legacy systems that are not ideally suited for it. Accordingly, money spent on technology has gone much more toward enhancement of existing platforms and channels than developing new digitally-enabled products.

This lack of investment over time is what will cause banks without smart answers to see significant revenue and market share declines. Customers demanding digital innovation will become dissatisfied and look elsewhere, including to non-banks and the absence of digital-led sales processes will cause missed opportunities for cross-sell of all-important fee generating business.

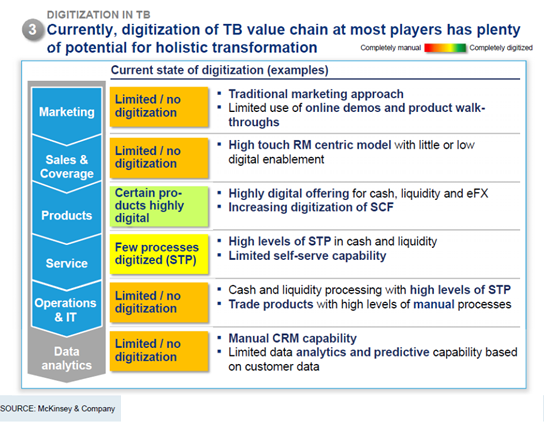

Looking at the current state of digitalization in transaction banking (see graphic, below), McKinsey sees potential for holistic transformation for the business.

Know your bank’s answers

Using this framework for future success in transaction banking, treasurers can ask their banks about their answers to the key challenges McKinsey presents. If they sound smart, then that is a bank that treasury may choose to partner with for the longer term. For example, are banks partnering along lines that reflect well on your recent experience using the services of both in key locations independently? And, are you encouraging banks to invest in digitalization by emphasizing digitally-enabled capabilities in transactions banking RFPs? Smart answers usually stem from smart questions.