Treasurers must prepare for global economic uncertainty as regulations change cash management practices and structures; meanwhile cyber thieves lurk.

The T30-2 fall meeting agenda combined challenge with opportunity, as members discussed the effects of bank regulations and how Dodd-Frank and Basel III are finally affecting how treasurers choose their cash management strategies for global activities. Cybersecurity is also a challenge that is top of mind for many members, as we witness an Increase in both the number of threats and the level of sophistication involved.

1) DF + B3 + QE = Trouble for Cash Management: Dodd-Frank and Basel III may be driving notional pooling to the bottom of the barrel.

2) Gone are the Days When Cash was King? With the upcoming 2016 regulations MMFs are likely take a tumble as the go-to option for short-term cash among investment managers.

3) Assessing Treasury Vulnerabilities to Cybersecurity Threats and the Risk Mitigation Response: Breaches may be impossible to prevent, so it’s better to focus on protocols for identifying and containing them quickly.

Sponsored by:

Bank Credit Facilities

After an extensive review of the new Dodd-Frank and Basel III capital requirements, one member company has recently begun to analyze its “share of bank wallet” and estimating the ROE that the banks earn on that share. This has led to a review at the commercial paper back-stop credit facilities that the company has with its bank group.

The company created a new facility to address these concerns while not giving away the store. This was a way to reduce growing CP balances with slightly off-market pricing to encourage banks but not significantly compromise overall cost of capital.

Relationship management also offers several new strategies for consideration. Historically, having a handful of small players in the bank facility was good for both sides: It helped build an additional bank relationship and allowed the bank to participate in a small way. Now however, things are different. Several members have asked small players to exit the bank facility to allow greater wallet allocation to strategic relationships. Small players are not happy; some were offended but left, while others refused to exit.

As the pressure to allocate the bank wallet takes top priority, small players may be asked to leave an existing credit facility to allow greater allocation of ancillary business to strategic relationships.

DF + B3 + QE = Trouble for Cash Management

Bank regulations have been on treasurers’ radar screens for years, but now things are getting real. Dodd-Frank and Basel III are affecting how banks do business, including which banks choose to remain in which business. Additionally, central bank monetary policies (quantitative easing) further the disruption to the rate environment and rate differentials globally. All this, in turn, affects the cash management strategies treasurers can utilize for their global activities.

Key Takeaways

1) It could be worse . . . you could be a banker. As we heard from one banker, “Everyone’s life is becoming ‘less fun.’ If your day is bad, our day is worse.” The increase in regulations has made the know-your-customer process restrictive and uncompromising, forcing banks to change their behavior, which has led to the inclination to “over-document and over-review.” This in turn adds time and leads to growing frustration for treasurers. As one member noted, “This used to be the easy part; now it’s incredibly hard to open a bank account.”

2) Is it sticky? Under the Basel III guidelines, banks are required to hold liquid assets to meet outflows of cash over a 30-day stress period. They must hold reserves of 40% against certain corporate deposits and 100% against some hedge fund deposits. Banks want sticky deposits, not the highly liquid in/out deposits that corporates have traditionally used the bank deposits for. Deposits over 30 days are more appealing to banks. Most foreign banks and especially foreign non-depository banks, still favor cash.

3) Demand for additional wallet. Many members discussed the added pressure by banking partners to be given more ancillary business. It is getting harder and harder to spread the treasury business around to a wider group of bankers; most want more than they are currently receiving.

4) Will notional pooling survive? Multilateral netting was previously allowed in The Netherlands, but since February 2015, The Netherlands Central Bank has adopted a new position that requires notional cash pooling balances to be reported on a gross basis for calculating the minimum reserve balance. Capital requirements for banks before the new regulation was introduced were considered to be insufficient, and they now need to calculate an LCR on a gross-value basis.

Outlook

It’s a whole new world for corporate treasurers as they work to understand the impact of Basel III on current cash management structures. Notional pooling is likely to be the biggest loser as regulators continue to press banks to calculate reserves on gross balances. This requirement could potentially sunset the traditional notional pooling model and force treasurers to redo existing structures.

Strong USD continues to cause pain

FX losses as a result of the continued strength of the USD made it a tough year for many. “It’s been a struggle even if we get a lot of things right,” said one member. Another chimed in: “We’re in every screwed-up country there is.” Emerging markets have been extremely difficult to manage and many members have written down their Venezuela exposure to almost nothing.

As cash balances continue to grow (with no viable tax holiday in sight), some members are getting creative in their methods to unlock these balances. One example included working with a local Egyptian broker to buy shares of local banks and then convert and sell them on the London Stock Exchange. An even more creative solution was bandied about, as well: if banks don’t want money and MMFs are changing, “maybe it’s time to start investing in one another directly” said one member, half-jokingly. But the reality is, maybe it is time to start investing in one another as a way to invest short-term cash. Several members discussed the reevaluation of their investment policies and the lack of short-term options. “We can have a swap meet,” said another member.

Gone are the Days When Cash was King?

Gone are the good old days when cash meant something. Banks are discouraging deposits, leaving treasurers to figure out where to place their cash to optimize the investment returns. Members discussed how they are managing this challenge, and PIMCO addressed a variety of economic events that are likely to affect your future cash investment decisions.

Key Takeaways

1) Where did all the supply go? The supply of short-dated “safe” assets has dramatically decreased, with T-bills down by $600bn, agency discounts notes decreased by $500bn, and dealer repo balances down by $300bn. This decline in supply is further challenged by the increase in demand for short-term assets as a result of money market reform and lower global yields.

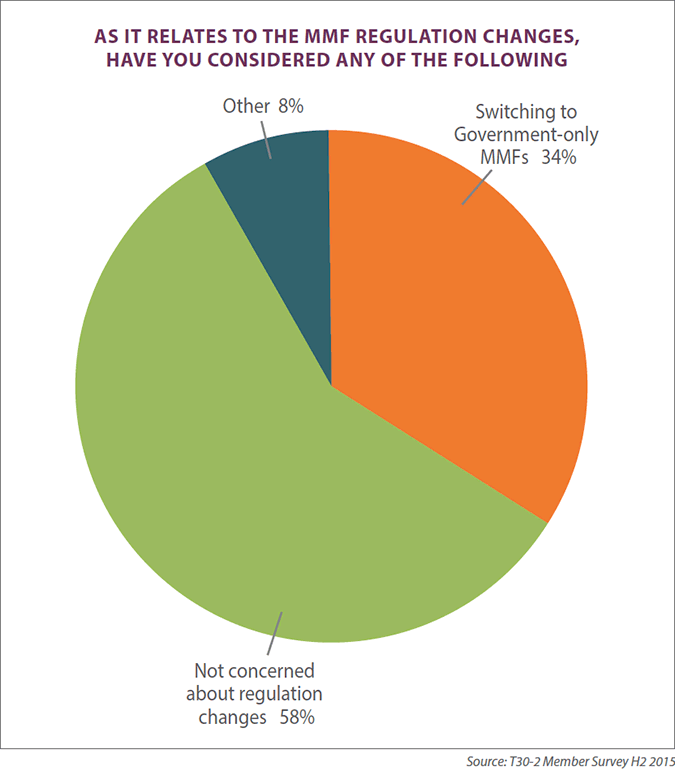

2) Is there a future for MMF? The use of MMFs is in question as many institutional programs are switching from prime to government-only funds, which are keeping the fixed NAV regime. This is expected to have a ripple effect with other programs announcing similar changes. MMFs won’t be as easy to work with in the future as investors are likely to have to give extended notice for withdrawal and may be required to pay a fee to redeem. Dollar-in/dollar-out is no longer the assumption.

3) Be sure you are being paid for the risk. As part of the session discussion, it was noted that many MMFs have waived their fees over the past several years, and it is expected that they will work to reclaim them as market yields increase. Members are encouraged to understand their MMF fees and be sure that they know how these fees are being offset against overall return on the fund. There will be a huge demand for government funds, which may result in the funds being closed because balances are too high, based on fund managers’ preferences.

Outlook

Placing short-term cash is getting harder and harder, and with the upcoming MMF regulations set to be implemented in 2016, it is likely that the MMF product will lose its original appeal as any easy go-to decision for short-term cash. Notice periods for withdrawal and potential fees on redemptions will quickly move MMFs to the background for many investment managers.

Gone Phishing

The majority of T30-2 members identify cyber risk as a distinct risk type with efforts to set risk appetite and measure exposure. One way to increase employee awareness and boost cybersecurity training is to create an internal phishing program that tests employees on their level of awareness. Société Générale, along with several member organizations, discussed their use of internal phishing campaigns to see how employees will respond to a variety of “free offers.” It has been noted that employees are often more careful at home than they are at work about clicking on inappropriate links. By using a phishing campaign companies are able to determine where employee training is needed.

Assessing Treasury Vulnerabilities to Cybersecurity Threats and the Risk Mitigation Response

This roundtable session assessed the various cybersecurity vulnerabilities that treasury faces with the systems, data, networks, and interfaces in its purview and the non-tech ways that cyber criminals will seek to influence illegitimate transactions.

Key Takeaways

1) Impersonating an authorized representative. Based on pre-meeting survey statistics, impersonating an authorized company employee or a legitimate banking contact and trying to direct illegitimate treasury transfers has been the most common type of threat members have experienced over the past several years. With this in mind, many members agreed that implementing company-wide training to alert employees of potential cybersecurity risks was a top priority. Placing high priority on this growing issue, 75% of members have created a cyber-risk committee.

2) Are these clouds safe? Does the use of cloud storage and SaaS make your data safer? The question is debatable, but members generally agreed that they would gladly pay a third-party provider to be responsible for the security of their data as part of the SaaS solution they provide to clients.

3) Plan a better crisis. It was agreed that the effort of trying to eliminate cyber-attacks is a bit like trying to fly a kite in a hurricane and that time is better spent on making sure your organization’s crisis protocols are as up to date and robust as possible. Having robust crisis protocols in place ensures your organization is ready for the “when” and not the “if” of cyber-attacks. What are your first-response actions when you are made aware of a cyber-attack? How quickly and efficiently can you contain the attack? Are your global systems affected or have you walled-off the threat? These are the types of questions that should be addressed as part of your crisis protocol.

4) No BYOD. There was a period of time when it was appropriate to use your own personal computer or smart phone to access work networks and systems. Those days are long gone as companies tighten security and strengthen IT protocols. Now, many organizations have robust monitoring software to help identify malware and red flags for potential breaches. The sooner you can identify it, isolate it and contain it, the better off you are. As companies move to fewer global instances of the corporate ERP system, the issue of containment becomes critical.

Outlook

The bad guys are getting smarter. Instead of working to stop an attack, experts recommend focusing on the crisis protocol for your organization to ensure it is robust and aggressive in identifying and containing a breach. Know what your critical steps are in the event a cyber-attack reaches your company.

CONCLUSION & NEXT STEPS

The continued strength of the USD was a primary focus for many treasurers this year. Many are taking a thorough look at existing hedge strategies to ensure they are mitigating the impact on USD earnings as much as possible. The lack of short-term investment alternatives will remain a focus in 2016 as MMF regulations are implemented and banks finalize their Basel III guidelines. Cybersecurity will also remain top of mind as organizations work to develop robust crisis protocols to identify key response tactics in the event they are hit with a cyber-attack.