Are you Ready for Real-Time? Payments That Is

By Geri Westphal

Not long ago the financial services industry would have viewed payments as the ho-hum, somewhat boring part of the sales toolbox. Given the rapid pace of change and the fundamental transformation taking place across many aspects of global payments, it is now seen as one of the most exciting and potentially valuable parts of our current financial system. As fintech firms seek to create more efficient ways to manage payments and regulatory changes continue to encourage standardization, there is new excitement in the world of global payments.

These fundamental changes call for a review of current treasury services, processes and business models. Now is the time to ensure that your business is ready for this significant structural change as consumers are far more digitally insistent and demand an easier seamless payment experience. We recently spoke with Thomas Halpin, Executive Vice President, Global Head of Payment Products at HSBC, to get his insight on the rapidly changing payments landscape and what treasurers should be doing today to prepare for the changes ahead.

We have heard a lot about fintech “disruption” and how these new innovators could significantly dislocate the revenue stream of traditional banks with “new and improved” payment practices. Disruption has been described as the creation of new and reconfigured ideas that make the customer experience in payments and banking more seamless and user friendly. Although it is true that many of these innovations are changing the way traditional transactions are processed, the phenomenon of “disruption” is turning into more of a collaborative partnership between banks and fintechs than an all-out fight for customers.

With the increase in mobile technology, there has been a huge shift in the way people interact with their money; lending, borrowing, paying and getting paid is all going digital and although B2C e-commerce has held center stage for some time, it is expected that these same payment innovations will permeate the B2B space very soon. Today’s treasurers are encouraged to stay ahead of these changes to ensure the most efficient payment processing possible.

- Instant Gratification. One of the more exciting innovations for the payments industry is that of real-time payments. Real-time payment infrastructures are spreading around the world and are expected to act as the payment backbone for standardization (i.e., ISO 20022). According to Mr. Halpin, “Real-time payment capabilities exist today in many forms but the primary difference with the “new scheme” is the enriched information that will travel with the payment. Clients’ expectations are much higher than ever before and it is no longer acceptable to not have real-time access to banking services.”

The case for real-time and other payment innovations is becoming increasingly apparent as technology advances continue. General market consensus is that these new services will quickly penetrate the market, and that there will be intense competition between services and service providers (banks or non-banks), which will help advance these new innovations. “It is also important to note that for true real-time payments to work the entire payment chain must be enabled, which will be a journey not a sprint,” said Mr. Halpin.

Another important component of real-time payments that treasurers must consider is that real-time does not necessarily mean the payment will arrive earlier. As real-time payments emerge, there could be a shift to just-in-time payments which depending upon your position as net payor or net receiver, could have an impact on your intra-day liquidity. Ultimately, Mr. Halpin believes that it will be in everyone’s interest for payment flows to be monitored throughout the day in order to prevent a “gridlock” across counterparty banks. This will be an aspect of real-time payment functionality that will be important to watch as the unintended consequences could have a great impact on how treasurers manage daily liquidity going forward.

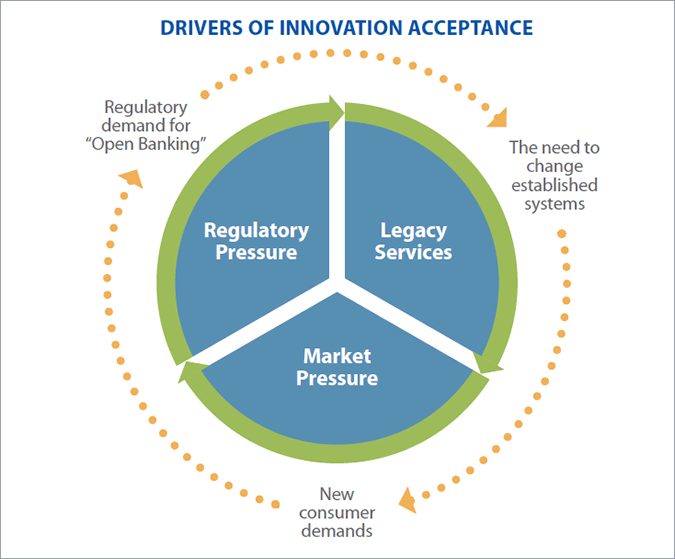

Global Market Adoption Varies. Payment modernization is a global priority but one of the biggest challenges is the varying level of standardization and innovation across the globe. According to SWIFT, eighteen countries have their real-time payment services up and running with many more at various stages of implementation. Mr. Halpin describes the “circle of innovation” and how it correlates with three primary drivers to determine the pace at which innovation can occur. The flow has an effect on the timing of payment modernization and those countries with long established schemes will need to modernize rapidly to deliver new services.

Some countries will benefit by “skipping” a generation in terms of payments infrastructure, as is the case with M-Pesa in Kenya. M-Pesa is a mobile phone-based money transfer, financing and microfinancing service, launched in 2007 by Vodafone in Kenya and Tanzania. According to Wikipedia, it has since expanded to Afghanistan, South Africa, India and in 2014 to Romania and in 2015 to Albania. M-Pesa allows users to deposit, withdraw, transfer money and pay for goods and services easily with a mobile device.

The three drivers of innovation acceptance include:

1) Legacy services. Most payment services have been established over many years and are deeply embedded within the back offices of businesses whether they be a corporate or bank. It can be difficult to change or modernize these legacy systems simply because of the size and scope of the overall project. As anyone who has made a change to a major ERP or TMS system can attest, this type of project is never smooth or easy. From a corporate treasurers’ perspective, their systems will be required to adapt to both new payment forms and new delivery times (i.e., real-time payments). For example, what will it mean to receive a client’s payments on Saturday or Sunday? How will they ensure their system reflects and assesses the appropriate collection period?

2) Market pressure. Today’s consumer demands a quick, efficient user experience via online retail e-commerce, which is creating market pressure for change and modernization that will spread from the B2C space to B2B as innovation continues.

3) Regulatory pressure. Regulatory policies and strategies are opening up payment services to non-banks and other providers and as a result, new possibilities emerge for payment innovation. In recent years, there have been large scale industry initiatives such as the introduction of ISO 20022, which delivered a harmonized message standard for the European region. It has subsequently been widely supported outside of Europe, bringing much needed standardization for treasurers in search of payment efficiency.

- Getting Ready for the Change. Mr. Halpin noted that it is likely that clients with US treasury operations who operate globally are already exposed to real-time payments in international markets, and to take advantage of the increased roll-out of this functionality, treasurers should consider performing an overall review of existing processes and develop a business case for the activity required to build or modify functionality that will allow them to fully participate in the advances of real-time payments. He identified the following key considerations that should be included in your overall review:

- How will real-time payments align with your existing processes, payment schedules, geography locations and other industry implementation schedules? How will a real-time payment made at a European SSC be recorded and will it be visible to US Corporate Treasury in real-time?

- Does your current system have advanced message format and syntax options that will allow the option to address beneficiaries using an ‘‘avatar’’ (e.g., email and/or cell phone number) to reduce burden of so-called Master Data?

- At what point should you consider adopting new technologies like e-Invoicing and virtual account structures to reduce overall cost of payment processing

- Find a Trusted Advisor. Most agree that digital innovation is going to change the financial services and banking industries as we know them today. Many believe that the traditional banking model is likely to become more customer-centric which means the bank will not rely on simply selling products, but will become an integrated partner with their clients to understand their entire business flow. The role of the “Trusted Advisor” will become popular and coveted. The key is to focus on the clients’ business and how to improve their processes holistically and not focus solely on payment processing. Fix the flow – not just the payment. Banks that adopt this new paradigm early will see the benefits and customer-centric banks will reap the reward.

Mr. Halpin said, “Clients are now choosing solutions based on their ability to provide more than just payment settlement.” He went on to say: “They are looking for new services that can transform how payments are initiated and often these payment discussions are a by-product of a broader business problem that is being solved. Banks and non-banks are focusing on becoming the “trusted advisor” to understand and solve these problems by focusing on the clients’ business, not just by focusing on selling a particular payment product.”

- What’s Next? The adoption of modern technologies including APIs and Big Data, along with SaaS and Cloud computing, has contributed to the rapid growth in the global payments industry. Clients expect full interoperability with their banks and transforming how banks and non-banks/fintechs collaborate in this space is important. According to Mr. Halpin, he expects a number of business models to operate in parallel going forward:

- Banks/fintechs will work together collaboratively to deliver services that are greater than the sum of their parts by leveraging each other’s strengths.

- Using modern technology, clients will experience deep integration between fintechs and banks, ensuring bank services (e.g. payment execution) are discoverable in context and easily consumed without interruption of business processes. Complementary and ancillary services will also be provided.

- Selected partnerships (investments and acquisitions) will occur between banks, fintechs and their mutual clients. These partnerships will help shape the development of next-generation services that make data processing and payment execution seamless, integrating other value-added services as required (e.g., FX, Trade Finance).

Contactless Increases

According to Mercator Advisory Group, the market expects a sharp increase in contactless payment cards and contactless-enabled POS terminals globally in 2016-2017. They expect contactless card use to outpace contactless mobile payments in selected markets due to consumers’ greater familiarity with contactless cards and the still emerging status of mobile payments.

The industry momentum and demand for more cost-effective transactions by consumers, businesses and other participants in the payments value chain is significantly contributing to the creation of new real-time payment systems despite the financial investment necessary to implement them. Real-time networks have the potential to drastically alter the way consumers and businesses make payments and interact with financial institutions. The convenience and other benefits to the end users are clear.

- It’s Not Too Early to Prepare. Is it too early to plan for these structural changes? Many experts say no. The speed at which technology changes are being introduced and adopted by market participants is faster than ever before, and real-time payments are already on the horizon. Based on input from Mr. Halpin, treasurers should be doing these five things now to prepare for real-time payments:

1) Understand the potential impact. Which geographies will accept and process real-time payments and what volume of activity is anticipated in each area? For example, does this new technology impact 5% of your total payment volume or is it closer to 75%? Take time to understand payment capabilities and business cases by country.

2) Plan your internal readiness. Consider resource availability, priority and senior-level buy-in when planning for a real-time payments project. It will not be a small undertaking and it will be necessary to include key business stakeholders, IT and operational SMEs. Don’t wait too long to start this project as real-time payment processing is coming onboard very rapidly.

3) Adopt market standards. Consider ISO20022 readiness on the corporate side as part of any treasury transformation or modernization project as a first step towards the implementation of real-time payments.

4) Increase efficiencies. Assess the opportunity to bring efficiencies through migration of payments to real-time payments. When is the right time to replace checks on the AR side? When is it the right time to implement e-Invoicing via “pull” payments supported by real-time, streamlining Master Data management through beneficiary avatars (where supported by the in-country real-time payment scheme).

5) Estimate liquidity impact. Consider the likely migration of receivables to real-time payments and what impact it may have on the concept of “just in time” settlement. What changes to daily liquidity planning are necessary to make the best use of your cash (both on the outbound as AP and on the inbound as AR; pay late and collect early)?

TAKE ACTION

The implementation of real-time payments is fast approaching and treasurers are advised to take steps now to ensure they are ready to handle these new payments. Managing liquidity will become much more dynamic with intra-day positions taking a more dominant role in the activities of day-to-day cash management. Innovation promises to change the way corporate treasury departments do business. Review your processes and technologies now so that you aren’t left behind.

Work Together Better

Late last year, HSBC launched a fintech innovation lab in Singapore that enables the bank to work collaboratively with corporates in developing the next- generation of digital and mobile banking services. The lab is staffed with a team of business and technology experts who focus on corporate banking needs in payments, trade and supply chain to share expertise and showcase trends and new technologies.

Sponsored by