The Assistant Treasurers’ Group of Thirty met in May in picturesque Kennett Square, PA, at the offices of Chatham Financial, the meeting sponsor. The broad agenda included sessions on global volatility in FX markets, organizational structure and staff development led by one company that just went through a split and another company that has many years of stability. The group also heard from a member on his comprehensive approach to capital structure and a leading money market portal company and its perspective on the forthcoming money market reform. Key points to consider stemming from the meeting:

1) Acquisitions and their aftermath. Following 2015, a record year for M&A, members are still digesting their targets and prepping for a possible next wave. Some are stepping back to review their companies’ organizational structures, such as shared service centers, and how treasury fits in. Similarly, several are reviewing their technology infrastructures, with some extending treasury systems to other regions and others replacing key modules as vendor offerings improve.

2) Currency volatility still top-of-mind. Solutions are varied and plentiful to hedge specific transactions or broader translation risk, and in some cases accounting standard setters have provided flexibility to apply them more readily. But there are no silver bullets, and tradeoffs are inevitable.

3) Treasury structure and staff development. Most treasuries remain somewhat hermetic, and exchanging talent with other departments in the company remains more an aspiration than a reality.

4) Funding strategies and capital structure. Updating capital structure is vital to keep activist investors at bay; find out what they would do to the company and copy it, only less severely.

FX 401: Digging Into Hedging Currency Risk

FX risk management remains a hot if not the hottest topic today among MNC treasury executives. Experts from host Chatham Financial provided the firm’s views on the FX markets, the hotspots, and approaches to effective FX management and strategy.

Key Takeaways

1) Last but not least. In terms of deal-contingent hedges, said a Chatham exec, some of the least-known banks—he pointed to Nomura in particular—are the best at pricing them. Look for banks with large portfolios of deal-contingent hedges, reducing their risk and pricing. Terms are everything. Deal contingent hedges are growing in popularity among corporates, he said.

2) Pumping up capacity. Using the long-haul method can help organizations expand hedge accounting capacity, said a Chatham executive director, but so can scrutinizing the company’s organizational structure and its various currency exposures. Then figure out what type of hedge is required and drill down to find all the instances where designated hedges can be applied.

3) Watching out for tail risk. Chatham reviewed the benefits of its Vine-Copula Modeling, which seeks to view a range of exposures holistically. Companies’ senior management tends to view models with skepticism, noting correlations can change, but those correlations aren’t held constant in the model developed by Chatham’s quants, and it seeks to replicate what happens in real-life.

4) Nothing’s perfect. Chatham looked at alternatives to hedge translation risk, and each required tradeoffs. Fixed-income forwards are agreements to forward purchase a US Treasury security with the proceeds of that contract, and the mark-to-market value is recorded in equity. However, not all accounting firms allow the transaction to qualify for hedge accounting.

Outlook

FX will likely remain a top concern for MNCs for the foreseeable future. FASB is amending its hedge accounting rules, providing more flexibility to achieve hedge accounting and impacting deal-contingent hedges as well as partial-term hedges. It is also prompting MNCs to move to the long-haul approach to achieve hedge accounting, one of several ways to expand hedge capacity.

Testing Financing Contingencies

Member presentations underscored the need for contingencies in financing, and that plays into the broader trend of corporates seeking to diversify their sources of funding. This means ticking all the boxes on accessing capital markets, bank and non-bank credit markets to ensure access to financing when they don’t really know what is going to happen next in financial markets.

One treasurer recommended actually tapping alternative funding options, including tier 2 CP to ensure that they will be there when needed. Also, if a merger involves a spin-off post-acquisition, treasury needs to have a contingency plan to go to market on an accelerated timetable when required, such as to fund the SpinCo when the pro forma financials are still valid and the parent is not in blackout.

Another member highlighted the need to build flexibility into your use of proceeds to avoid having to turn to capital markets both to take out a bridge and raise subsequent capital for a recap. Similarly, you can negotiate a draw provision in a bridge loan, so that it can be drawn on without triggering the takeout.

Treasury Structure and Staff Development

The assistant treasurers from major technology and health companies—the first having just completed a major restructuring and the second more stable but experiencing slowing growth—reviewed their department structures and approaches to staff development.

Key Takeaways

1) Treasury by the numbers. Core treasury staff at member companies numbered 20 on average, with the smallest at two and the largest at 50; Total treasury averaged 45.7. Most respondents, or 47%, described turnover in their departments as low, while 43% said moderate and 10% high. The most common reason for treasury staff leaving was more growth opportunity elsewhere. And then there are terminations. “More people get canned for social issues than technical deficiencies”, noted one presenter.

2) Treasury dis-synergies. One of the ATs presenting said corporate splits tend to result in greater focus, leaner management, and synergies for much of the company. Treasury, instead, has to double its compliance efforts, divide treasury systems and collateral programs, and open new bank accounts.

3) Staff rotation challenges. Finding a balance between staff who understand the treasury function well and those brought in from the outside for training, hopefully with new ideas, can be challenging. One presenter said his company pays for pursuing the CFA as well as the CTP. “We also encourage people to attend NeuGroup meetings,” he said to chuckles.

4) It takes a dictator. Sooner after the first company’s restructuring was announced, treasury developed a long list of milestones, many of them major projects. The AT said he turned into a “bit of a dictator” for the next year; the staff rallied and consultants were brought in to help manage the project. “It’s all very interrelated,” he said. “Until you set up treasury systems, you can’t move cash, and until bank accounts are established you can’t move money. Good project management with a lot of extra help allowed us to survive.”

Outlook

The liveliest interaction came toward the end of the presentations, when the presenters talked about staff development — moving people into different roles in treasury and exchanging executives with other parts of the company. As treasury departments continue to look for ways to automate to keep staff size small, adequate cross-training for back-up purposes will be necessary.

Where Now With Your Capital? Solving the Rating Agency Puzzle

While most members would like to see better alternatives to the current rating agencies emerge that did not overcharge for the value they offer, no real alternatives are on the horizon. According to Karl Pettersen, Head of Ratings Advisory for the Americas at Société Générale, however, treasurers do have more of an opportunity to steer the rating narrative toward a better rating outcome.

As more and more corporates drift into the BBB range of investment grade, financial policies become more critical. Rating agencies are more nervous because growing cash balances are often offshore and activist investors are pressuring corporates to become more aggressive with their balance sheets and subject to event risk — in a world where event risks are prevalent.

In response, treasurers need to evaluate their financial policies around four factors: leverage, liquidity, shareholder distributions and capex/M&A. They should evaluate these four factors against all scenarios and articulate how financial policies and strategy will respond with them to rating analysts. “Give them the impression that you are running the business for them,” noted Karl. The rating story should be told in the rating agencies’ language of key stated ratios and fully adjusted metrics.

Funding Strategies and Capital Structure

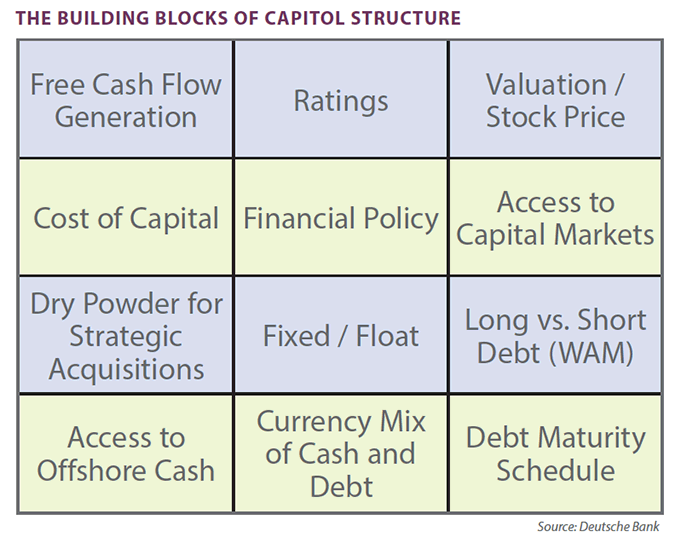

The AT of a major consumer products company received high praise for his review of capital structure basics, setting the stage for a detailed description of his own company’s approach. He was well versed in the subject after completing a review requested by his boss a year ago, noting that “the building blocks and the questions are the same, but the answers are different based on the changing markets, currency values, risk tolerance, etc.”

Key Takeaways

1) Nailing down the basics. The company’s treasury comprises a 12-person-strong staff in its headquarters, a few people in Europe and local teams in various locations that the company is now looking to consolidate into regional treasury center teams. The AT queried the group about the best title for the regional treasurer, and at least three participants responded “director,” with another suggesting “senior manager.”

2) Do unto yourself as others would do unto you. The AT reminded peers about debt and equity investors’ priorities, and said rumors about a hedge fund eyeing his company have prompted his boss to ask perpetually whether the company is doing what the activists would do, “but not quite as severely.”

3) Duration decisions. The rate on 30-year debt today is historically low, but it must support the company’s needs. “If I’m going to be building a factory today that makes [products], the cash generated from it probably has a duration of eight or nine years, so that’s where my funding should be,” the AT said.

4) The fixed/floating balance. A company’s balance of fixed- or floating-rate debt depends on several factors, including its industry and where it wants risk exposure. Nevertheless, “a 10-year swap paying floating outperforms fixed 100% of the time, and even the 5-year swap wins 89% of the time. It’s very compelling,” the AT said, adding tongue and cheek, “except before the Fed raises rates.”

5) US on T-locks are better. The AT’s company will pursue pre-issuance hedging up to 50%. The AT favors T-locks, although they lack liquidity and banks will charge a fortune if they have to be rolled over. Whether due to regulations or something else, he said, European banks’ pricing for T-locks is much worse than US banks’.

Outlook

The numerous variables that influence capital structure are constantly in motion. So keeping up with a suitable capital structure is a task that should be reviewed fairly frequently to make sure it is as efficient and appropriate as possible. And do so with an eye to activist perceptions, to hopefully keep them at bay.

TMS Implementation — A Reality Check

While a new TMS gives treasury a “new car with more features,” you have to take some time to learn and develop the skill to take advantage of the functionality before it can fully measure up to the business case. Thus, a treasurer’s enthusiasm should not get too far out in front of the realities of treasury staff learning what their new TMS is capable of.

One of the key takeaways from a member presentation of key impacts of his TMS implementation was that it enables his people to anticipate and get in front of problems — instead of chasing them. In this way, the TMS project was not about headcount reduction but repurposing people away from clerical jobs and getting them more excited about their work.

In this rollout, a third-party advisor was critical to the success of the implementation. The member used the TMS vendor as its principal consultant. The TMS provider has a feature-rich system, and while they know their system, they will be reluctant to tell you how much you really need and how much you don’t. A third-party can help focus you on what is needed and not needed.

Sponsored by: