And avoid letting the Single Euro Payments Area become a compliance nightmare

The due date for SEPA migration is less than a year away but many companies remain ill-prepared. A shift in mindset should end the complacency – A special supplement sponsored by Deutsche Bank.

Nobody likes to be forced to do something—even if that something is the right thing to do. This is the case with regulation to create the European payment system, Single Euro Payments Area (SEPA). The message of opportunity embedded in SEPA preparation, unfortunately, has taken a back seat to the mandate the European Union (EU) felt obligated to put in place on March 31, 2012. The EU’s vision was to support a single Eurozone market with a single payments area along with the under-appreciated adoption of a single XML format, based on the global ISO20022 standard. By mandating end-to-end adoption of the SEPA payment format based on ISO20022, corporates can now standardize processes and systems on a single format for the 32 countries of SEPA. This will vastly improve their ability to centralize and automate payments and collections in the largest economy in the world. Treasurers can also use it to catch up to, if not get ahead of, the changes shaping the next generation of treasury and shared service centers globally.

“It’s almost a dream come true for treasurers who are working on the grand treasury themes of automation, standardization and centralization,” says Martin Runow, Head of Cash Management Corporates of the Americas, Global Transaction Banking, Deutsche Bank.

And yet despite the opportunity and a February 1, 2014 deadline, preparations for SEPA have been woefully inadequate for too many firms. “This could be the missed opportunity of the decade for many corporates,” noted one assistant treasurer of a large, NeuGroup member MNC. A poll taken at the NeuGroup’s recent Global Cash and Banking Group meeting indicated that only 9 percent of the members believed they were 100 percent ready to transact using the SEPA standard format. Another 23 percent believed they were more than 50 percent complete in their timeline, but the vast majority, 68 percent, felt they were less than halfway there.

According to the European Central Bank, when it comes to the actual implementation, a number of companies have adopted very late internal deadlines, even as far off as the end of 2013. “Late migration is highly undesirable in projects like SEPA, where many technical details need to be reflected in end-users’ back-office systems and internal processes.”

Deutsche Bank’s Mr. Runow agrees. “Too many companies are underestimating the work that will be needed,” he says. “To get to the SEPA promised land companies need to take action now. At this point companies need to get to basic compliance.”

Avoiding the nightmare

Treasurers should be coordinating with their business and finance manager colleagues, customers, suppliers and service providers to review current payments infrastructure and implement the minimum changes necessary to ensure tactical compliance with the SEPA rules. But even as they move to avoid the nightmare of non-compliance, forward-thinking treasurers will keep their dream goal in mind.

While a company with a limited number of euro payments might choose to avoid SEPA mandates entirely and change their method of payment to wires (or other methods outside SEPA’s scope), most companies have far too many bulk payments to opt out, or justify moving from a cost of 10 cents to 10 euro per transaction. These firms must weigh the cost of executing a preparation plan versus the cost of rejected payments submitted in non-SEPA formats, including their payroll payments; the staffing costs to manually intervene to remedy these rejections before or after they occur; or the fees payment service providers will ask for to undertake exception processing that runs counter to mandated regulation. This will quickly eat away at operating margins for many large firms.

At a minimum, firms must update all legacy bank account numbers in their systems with International Bank Account Numbers (IBANs) and related Bank Identifier Codes (BICs), the latter being required for euro cross-border payments until February 2016. Conversion services can help in the process, but it can still take 1-2 months in the best-case scenario. Not only will IBANs and BICs ensure payments continue to flow after February 1, 2014, but—with the proper information—banks like Deutsche Bank can take your legacy payment file and convert it to SEPA-compliant XML with a much higher probability of success. However, not all banks will offer such solutions, meaning your payments will face a risk of being rejected. Implementing these conversions before the deadline will also allow banks to offer you more value-added services that deliver on SEPA benefits (see below).

Hidden Benefits to IBANs

Deutsche Bank’s new Accounts Receivable Manager (ARM) for SEPA product—piloted with PayPal—is a great example of how the Bank can go much further to help improve centralized payment processing efficiency if their customers will take the tactical first steps like convert their bank accounts to the new IBAN.

“What IBANs do is provide a structure for the bank account number that is validated across all banks within SEPA in exactly the same way,” says Arthur Brieske, Global Head of Commercialization, Global Transaction Banking, Deutsche Bank. Thus, IBANs are ready-made to serve as unique identifiers for routing of payments. Deutsche Bank took this identifying feature and used it in its ARM for SEPA product so that companies would not have to create a proprietary identifier for receiving payments and link customers’ payments to their required remittance information via an IBAN that all of them in the SEPA zone are mandated to use. This also encourages them to convert to IBAN themselves.

“The further advantage of this approach is that it makes customers’ collection platforms more bank agnostic,” notes Mr. Brieske, “since any SEPA-compliant bank’s systems will be set up to work with IBANs.”

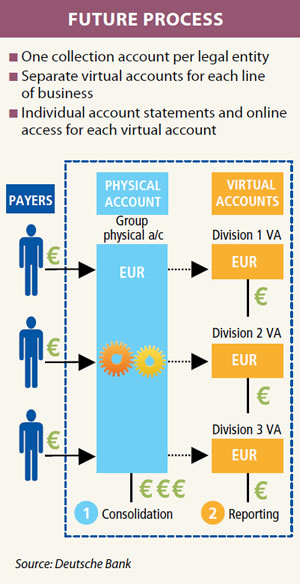

Deutsche Bank also took this IBAN benefit and applied it to virtual accounts. Corporates with a centralized collection platform using ARM for SEPA can set-up virtual accounts with IBANs for all of their business units and ask customers to remit to these accounts. Since these virtual accounts are mapped to the physical collection accounts, corporates gain flexibility to both consolidate the number of physical collection accounts now and in the future without having to go out to their sales channel again. Often the customer has no idea they are remitting to anything other than a local bank account.

Meanwhile, the required payment reference information sent with the payment directly to the virtual collection account of the recipient is much more likely to remain intact and be auto-reconciled. Deutsche Bank says that many firms using this platform have a real chance of obtaining 100 percent auto-reconciliation.

In the case of PayPal, the structure makes use of millions of IBANs for its customers, allowing fully-automated payer identification.

Until it helped develop ARM, PayPal had to contend with an unacceptable amount of returned payments on a daily basis. Additionally, the company had to battle payments with missing or inconsistent information, which then had to be processed manually. This was an unacceptable user experience, according to Katja Lehr, Senior Manager for Global Core Payments at PayPal. And as a global organization, it was important for PayPal to have a single solution which works throughout Europe, “while also providing the look and feel of a local solution to our users,” she said.

To ensure your employees in Europe get paid without delay, it is also a good idea to ensure payroll systems are prepared to deliver fully compliant SEPA Credit Transfer (SCT) payment instructions. Human Resources (HR) will certainly want this to be part of minimum readiness.

On the direct debit side, there is a bit more to do than with credit transfers. In addition to the IBANs and BICs, there is an end-to-end reference code. This code offers a significant advantage for creditors submitting large numbers of direct debits and allows for centralized processing as it greatly simplifies the automatic reconciliation of returns. Also, companies planning to use a SEPA Direct Debit (SDD) will need to apply for a Debtor ID and produce a Mandate ID that would accompany each direct debit through the clearing system. Furthermore, they need to look into their mandate management processes.

Since failures in bulk payments, collections and payroll are operational nightmares, treasury should enlist procurement, payment and collection functions, the relevant shared service and Business Process Outsourcing (BPO) organizations, plus HR in the effort to build the business case if compliance with the EU SEPA regulation is not enough for your SEPA migration to be completed by the deadline. This will avoid the nightmare, but it will not yet make your dreams come true.

XML: One Company’s Story

The simplest way to make SEPA a stepping-stone to the next next-generation platform of your dreams is again to focus on the migration to XML. Organizations that have already committed themselves to the ISO20022 standard for payments, be it via integration with SWIFT or system upgrades using XML formats for data sharing across enterprise platforms, will have an easier time complying with SEPA mandates. Moving to XML is widely considered best practice in any event, and even as many local payment systems move to standard XML formats the need to migrate cannot be ignored.

This was certainly the case for the luxury brand group LVMH – Moët Hennessy Louis Vuitton, which began converting to SEPA in 2010. For LVMH, it was the closing of the French bank/corporate data communications network, Echange Télématique Entre Banques et Clients (or “ETEBAC”), and the possibility to use only one format (ISO20022) together with SWIFTNet for exchanging financial instructions with most of the banks worldwide that provided the impetus. The use of the XML format would also tackle SEPA at the same time.

According to Arnaud Lajoinie, LVMH’s Head of Project and Organization – Financing and Treasury Department, replacing ETEBAC had to be considered in conjunction with SEPA. In March 2010, the majority of the Group’s treasurers met to discuss the two topics, with the outcome being a decision to build and onboard a global communications solution based on the global interbank telecommunication network SWIFT and XML.

Each of our brands operates independently—they are not dependent on LVMH, and therefore could have opted out of the global solution—securing buy-in was not particularly difficult,” Mr. Lajoinie says. “We were one of the first adopters of SWIFT back in 2007, which made it a ‘pressure-free’ decision; and there are obvious treasury benefits to a global solution.”

Of the migration to XML and the transition to SEPA, Mr. Lajoinie says, “XML is the designated format for SEPA transactions, but for us the migration to XML went beyond the transition to SEPA. We consider SEPA to be the catalyst rather than the driving force for XML migration. SEPA had a clear impact on European banks, which have fastened their abilities to acquire XML.”

In fact, Mr. Lajoinie puts the desire to adopt XML ahead of the move to SEPA. “SEPA migration alone will be responsible for around 70 to 80 percent of bank flows, but XML can deal with all payment needs within and beyond Europe,” he says. “When you think of the number of differing local payment formats—there are over 100 in Europe alone—the ability to deal with just one is ideal from an ERP perspective.”

Next steps toward the dream platform

With a commitment to XML conversion on the systems side, treasurers can then look to use SEPA as a catalyst for a large move toward the next-generation platforms in shared-services.

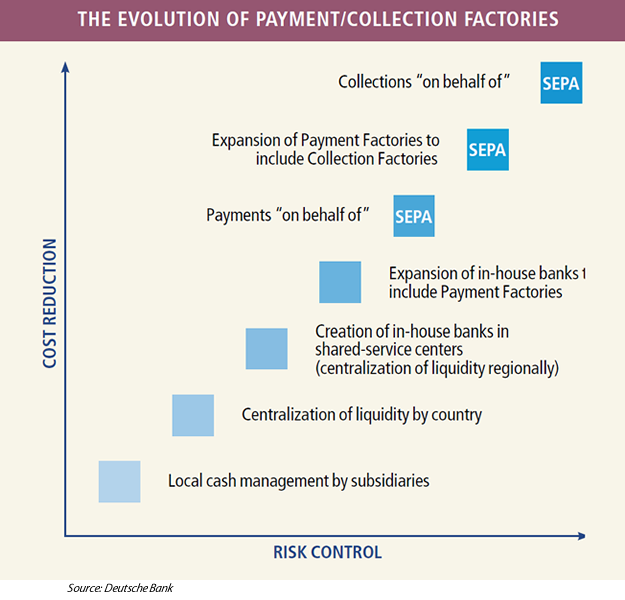

Through its work, and in conjunction with corporate clients, Deutsche Bank has identified several opportunities presented by SEPA to move forward with a next-generation treasury/shared services platform. For example, the evolution of centralized payment factories can now be more readily complemented by centralized collection factories. One clear advantage of the SEPA file formats for payment/collection factories is that it includes an “On-behalf-of” field. This optional field has a maximum of 70 characters and caters to the centralization trends of both originators and beneficiaries. Deutsche Bank’s focus on the evolving centralized platforms for treasury services is consistent with the priorities of NeuGroup members, who have made it a frequent topic for discussion with their peers. Any corporate interested in further integration of treasury operations with shared-service centers should be taking advantage of SEPA.

Deutsche Bank describes the evolution of centralized platforms in the form of Shared-Service Centers (SSCs), In-House Banks (IHBs) and Payment/Collection Factories. While each may have once been considered a separate organizational vehicle, the distinctions between them are blurring. What they tend to have in common is that they operate as cost centers focused on supplying standardized, recurring services to affiliated business units more efficiently and effectively.

Generally speaking, an SSC will provide a multiple-entity organization with the widest array of specialized services. These can move accounting, human resources, IT, security, along with liquidity management, or accounts payable and accounts receivables services closer to a treasury center’s operations. Usually, the basis for the provision of services is a Service-Level Agreement (SLA) between the participating entities with cost allocation on the basis of agreed-to transfer pricing. While treasury has often been inclined to create separate treasury centers, which have a tendency to evolve into IHBs, the current trend is to fold treasury centers or IHBs into broader SSCs; or, where they don’t yet exist, create an IHB within an SSC.

Both situations fit another common evolutionary trend—using the centralized liquidity of the IHB to centralize payments via a payment factory. As noted, SEPA creates opportunities to further develop the payment factory by extending pay-on-behalf-of services to more affiliates and expand the concept to the collection side, a collection factory, to offer receipt on-behalf-of-services. In the context of platform evolution, therefore, SEPA provides corporates with a catalyst to not only expand the scope of their existing IHB/payment factory, but also a vehicle to further integrate and consolidate their treasury and SSC platforms in Europe.

Finally, given the many process and system changeover steps and file formats used—all based on the ISO20022 standard—revisions to the platform in Europe will help global bank payment connectivity via SWIFT, global payment platform centralization/integration and many other related benefits too. With all this in mind, treasurers can have a much more compelling case to jump into a SEPA project that emphasizes these benefits in addition to tactical compliance with mandated rules.

Getting going

If all this isn’t enough to you excited about engaging more with SEPA, just keep in mind that the difference between realizing the dream and getting caught in a nightmare is putting off your migration plan for too long.

If your company has not yet engaged, get started with IBANs and BICs and a review of your systems (and those of BPO partners) touching payments to ensure they can handle the 16-digits needed. Those that cannot are overdue for an upgrade or replacement. If you have started the process, ensure you do the right thing and move your payments infrastructure further down the path of utilizing the XML-standard, now mandated for SEPA. Either way you’ll sleep better dreaming about the opportunities you have created to reduce cost instead of what it will cost you to escape the nightmare of your firm’s procrastination.

Deutsche Bank Contributors

|

Martin RunowHead of Cash Management |

Arthur BrieskeGlobal Head of Commercialization |

Sponsored by:

For more information:

Deutsche Bank’s “Ultimate Guide to SEPA Migration” is available for download on iPhone, iPad or iPod touch with iBooks and on computer with iTunes or from Deutsche Bank’s website.

![]() To download this supplement as a pdf, click here.

To download this supplement as a pdf, click here.