By Ron Chakravarti and Ann Lin Khoo

Despite a pause in 2015, China will continue to be a major force in the global economy in 2016 and beyond.

While the juggernaut that is the Chinese economy slowed in 2015, it continues to remain a major growth market for many of the world’s leading multinationals and is expected to be a key driver of the global economy for the foreseeable future. As 2015 draws to a close, it is worth looking back at a year of significant change in China, and to consider the year ahead.

Throughout the year, China continued to take steps to open up its economy and demonstrate its commitment to promoting the renminbi (RMB) for cross-border trade. While onshore foreign exchange (FX) markets remain tightly regulated, the expansion of the Free Trade Zone (FTZ) pilots have improved the ability for China-incorporated entities to access offshore funding and FX markets. Then, in August, the People’s Bank of China (PBOC) allowed a wider band in the RMB / USD FX rate and the RMB depreciated against the dollar. Towards year-end, the International Monetary Fund (IMF) decided on including the currency in the Special Drawing Rights (SDR) basket. And, in December, the China Foreign Exchange Trade System (CFETS), part of the PBOC, introduced a new exchange rate index that will see the RMB valued against a basket of 13 trade-weighted currencies rather than only against the dollar.

All in all, expectations are for RMB internationalization to continue and for market forces to gradually assume a greater role in determining the value of the currency. This implies less predictability in the FX rate in future, which will be an important factor in corporate liquidity and risk management strategies. The changes have opened the door to new opportunities for multinational treasury teams in liquidity management and cash control in China.

Mitigating FX Risk

Volatility around the recent depreciation of the RMB has made it more pressing to centralize risk management capabilities to more effectively manage FX exposures. Previously, restrictions on free movement of RMB meant that FX risk management strategies were based around exposures at onshore entities, instead of being centralized at the regional or global level. Offshore hedging was possible using approaches such as non-deliverable forwards, but deployment of forwards and other currency risk strategies were fraught with their own challenges.

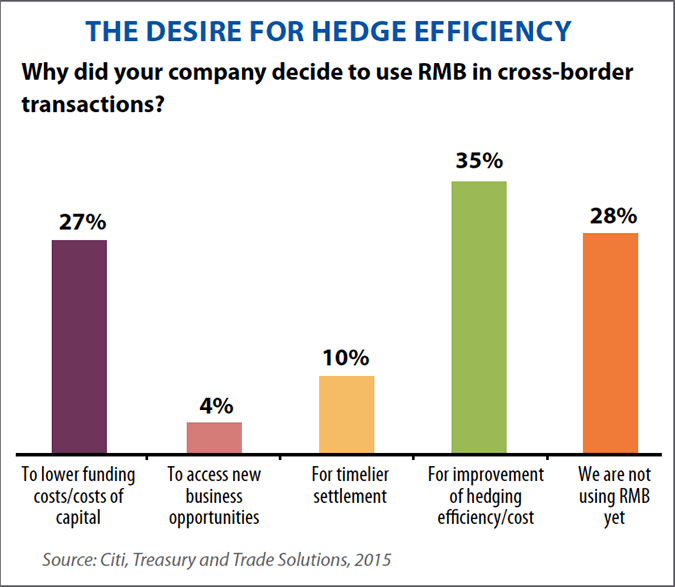

In the current climate, corporates may reduce currency and funding mismatches by switching to RMB invoicing and settlement. Assuming affiliates or third-party suppliers and customers can be encouraged to accept RMB, this approach may go a long way toward reducing FX exposures and enhancing risk management. At the very least, companies may utilize their China entities to pass FX exposures to affiliates abroad, and then further centralize risk management to regional treasury centers that may be better positioned to manage hedging activities.

In addition, in a bid to improve the transactional efficiency of RMB as a settlement currency, the Chinese government has announced the launch of the Cross Border Interbank Payments system (CIPS), which streamlines the current settlement model that currently presents several challenges of multiple clearing banks and varying payment cut off times. CIPS is designed to optimize the route for settlement.

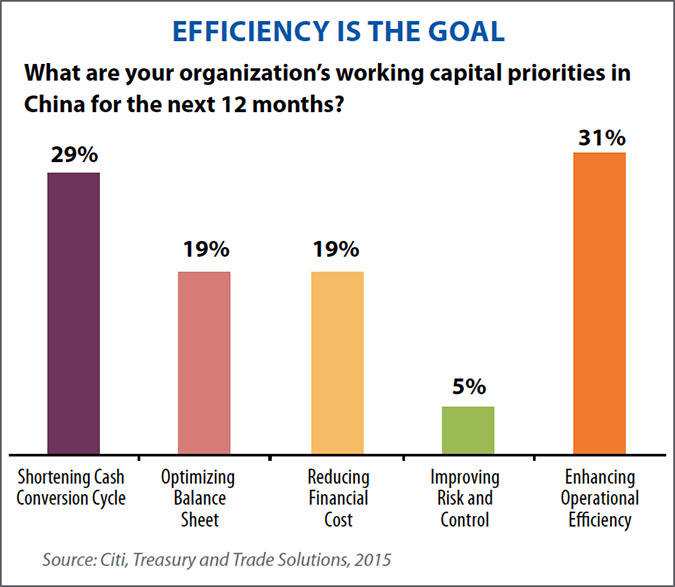

Achieving efficient banking structures and freeing trapped cash. In the past, exchange controls and other currency-related restrictions in China created an environment where corporates ended up with inefficient banking structures and trapped cash. For example, the requirement that hard copies of all supporting documents be delivered to the local bank with cross-border settlements made it very challenging to rationalize accounts.

Fortunately, these requirements have eased and trade settlements can often be completed on a paperless basis, using digital copies of pertinent documents. This has allowed companies to rationalize domestic account structures with their regional or global bank, while dramatically improving efficiency by leveraging paperless solutions.

Another challenge corporates have faced has been their inability to incorporate China into global liquidity structures due to restrictions on the cross-border movement of cash. This resulted in trapped cash. Recent changes now enable multinationals to connect domestic operations with cross-border liquidity management structures. Qualified companies with regional headquarters, operating centers and international trade settlement centers can pool foreign currency or RMB with offshore entities under more relaxed requirements.

Netting, in-house banks, and POBO offer opportunities to increase efficiency. Until recently, advanced treasury structures, such as netting, in-house banks and payments-on-behalf-of (POBO) were not possible in China. Today, RMB and foreign currency netting is permitted under PBOC and State Administration of Foreign Exchange pilot schemes. Now, advanced treasury structures offer multinationals an important opportunity to increase the efficiency of cross-border treasury management, as well as benefits in foreign exchange risk and liquidity management in the region.

Regulatory changes also allow the deployment of cross border POBO and receipt-on-behalf-of (ROBO) structures within certain considerations. In the case of foreign currency cross-border flows, which are regulated by the State Administration of Foreign Exchange, approved pilot companies can establish an entity in China to make or collect foreign currency payments on behalf of their China affiliates. Qualified companies can even extend their POBO/ROBO counterparts from affiliated companies to external companies in the same supply chain.

Looking Ahead to 2016

A number of key regulatory milestones have been completed in recent years and the outlook is for continued easing in how multinationals conduct business and manage treasury.

With the significant changes that have taken place over the past several years in China, multinationals have the opportunity to integrate their China treasury management into established global processes. Expectations are also of a slower pace of change in guidelines for cross border treasury structures. And, with market forces driving the value of RMB, FX rates may be more volatile. All of this suggests that corporates that continue to put off internal implementation, as they ponder the regulatory outlook, may face real opportunity costs in control, efficiency, and effectiveness.

At the same time, in an environment that remains complex, corporates put themselves in the best position to take advantage of China’s evolving treasury landscape by maintaining close dialogue with a banking partner that has deep experience servicing leading multinationals, strong relationships with the regulators, and integrated local and global capabilities to meet all of treasury’s needs. The right partnerships can go a long way in the growth engine that is China.

Ron Chakravarti is a Managing Director at Citi and Ann Lin Khoo is a Director in Citi’s Treasury and Trade Solutions.