By Mary Ann Dowling

The next several months will show more clearly how the Dodd-Frank Act will affect the way companies do business.

Planning for the impact of the Dodd-Frank Act has been difficult because so many rules have yet to be finalized. The delay in derivative transactions rules until December 2011 has left treasurers unsure about what foundation-building steps they should take now. Some companies have taken action, some are waiting for finalized rules, and some think the legislation will have little effect on them. What potential requirements and changes will corporations face?

Planning for the impact of the Dodd-Frank Act has been difficult because so many rules have yet to be finalized. The delay in derivative transactions rules until December 2011 has left treasurers unsure about what foundation-building steps they should take now. Some companies have taken action, some are waiting for finalized rules, and some think the legislation will have little effect on them. What potential requirements and changes will corporations face?

Dodd-Frank is a massive piece of legislation affecting many different areas in treasury operation. The legislation calls for more than 300 new rules and 75 studies by multiple regulators. Congress is trying to stabilize the banking system to avoid the disastrous consequences of the 2008 financial crisis but it has become a daunting task filled with distracting uncertainties.

Some rules impacting corporations have been finalized. On the governance side, the Act has proposed rules that encourage whistleblowers to report any kind of securities violation, by offering rewards of between 10 percent and 30 percent of the funds recovered exceeding $1mn. Also, the Act gives shareholders a greater role in “say on pay” and “say on golden parachutes.” The “say on pay” rule allows shareholders, at the annual meeting, once every three years to approve the compensation of executives as disclosed in SEC filings. The “say on golden parachutes” rule gives shareholders the right to approve payments made to any executive in connection with a merger and acquisition transaction.

There are rules for securitized lenders designed to protect the investor. Companies are required to hold at least 5 percent of the credit risk unhedged.

In addition, asset-backed issuers must review the underlying assets in a disclosure outlining:

- The nature/scope of the review.

- The findings/conclusions.

- How an entity or entities were selected.

- The factors used to make a determination.

- The quality and underwriting of the asset.

- The specific minimum credit score of the entity.

- The review-samples asset in a large portfolio.

Companies with consumer finance operations will be subject to Consumer Financial Protection Bureau (CFPB) oversight. This new organization will consolidate the efforts of several different regulatory agencies. Because thousands of companies will be subject to its authority, the CFPB will probably focus initially on companies receiving the most consumer complaints.

Changes for banks that result in lost revenue, like the repeal of Regulation Q and the lowering of debit card interchange fees along with Basel III capital requirements and FDIC insurance, will surely increase a company’s costs for bank transactions and services.

Derivative Proposed Rules. Ostensibly, the major goal of Dodd-Frank is the reduction of systemic risk in a broad sweeping effort to protect the investor. By regulating over-the-counter derivatives, it is hoped that market risk will be minimized and investors will not be penalized. The act introduces a regulatory framework for the derivatives market that up until now has been left unregulated.

As the act is implemented there will be significant changes to the American financial regulatory environment. For example, a new regulatory arm, the Financial Stability Oversight Council (FSOC), has been created, which is charged with identifying threats to US financial stability, promoting market discipline, and responding to emerging risks to that stability.

FSOC can designate non-bank companies to be “systematically” important and then subject them to Federal regulation. Prime candidates for this designation are those supporting payment, settlement, and clearing of payments, and information technology service providers, companies deriving 85 percent of their revenue from financial activities or those with a significant derivative portfolio. Systemically at risk non-bank financial companies will be subject to Federal Reserve Board oversight.

Another rule mandates that systemically important companies establish risk committees on their management boards. These risk committees must include a number of independent directors as determined by the Federal Reserve, while at large complex companies there must be at least one risk management expert on the board.

Swaps. Swaps cover interest rate, currency, cross currency, foreign exchange, energy, emissions, commodity, total return and credit default swaps, and those transactions that use swap master agreements. However, the US Treasury published a document for comment on April 29, 2011, stating FX swaps and forwards should not be treated as derivatives. This has not been finalized. FX non-deliverables, options and currency swap contracts continue to be part of the swap definition. Most corporations use non deliverable forwards to hedge their exposure in emerging markets that have capital controls.

Derivative Regulators. The Dodd-Frank Act divides regulatory authority over swap agreements between the CFTC and SEC as follows:

- The CFTC – primary regulatory authority over all swaps, including energy and agricultural swaps.

- The SEC – regulatory authority over “security-based swaps,” which are defined as swaps priced on a narrowly based security index, a single security or loan, or the occurrence, nonoccurrence, or extent of occurrence of an event relating to a single issuer of a security or the issuers of securities in a narrow-based security index, if the event directly affects the financial statements, financial condition, or financial obligations of the issuer.

- The CFTC and SEC share authority over “mixed swaps,” which are security-based swaps with a commodity component.

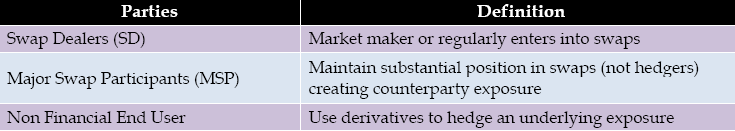

Parties to Derivative Transactions. There are three parties that can transact derivatives:

Proposed Process for Trading. All SD and MSPs must register with the CFTC. They will be subject to capital and margin requirements and must post and collect initial and variation margin. Swaps that are subject to clearing must be executed on a board of trade or swap execution facility (SEF). The trade execution requirement will not apply if there is no board of trade or SEF that makes the swap available to trade or if the swap is not subject to the clearing requirement.

Central clearing is required for financial companies but not end users; however, an end user may elect to clear the swap and will have the sole right to choose the clearinghouse. Clearinghouses are Chicago Mercantile Exchange, London Clearing House, and International Derivatives Clearing.

There will be real time price and volume reporting, since every swap is subject to reporting requirements whether cleared or not. The SD or MSP are required to report the swap data to the swap data repository (a registered entity that will collect and maintain information or records with respect to transactions or positions in, or the terms and conditions of the swaps) or the CFTC or SEC. If neither party to the swap is the SD or MSP, then the parties have to decide which will be the reporting entity. End users are not responsible for reporting a transaction if the trade is done with an SD or MSP.

Transactions with end users who elect not to clear will include in its pricing some compensation for the additional costs the banks will incur to process transactions and report them to the central repository.

Non-Cleared Transaction Proposed Rules. Non-cleared swap rules were published in April for comment but are also not yet finalized. Swaps with non financial end users will be treated differently by the two proposed regulators as listed below:

Both regulators agree that it is not mandatory to segregate the margins. However, the proposed rules give commercial end users the right to require that any initial margin they post to secure uncleared swaps be segregated by an independent custodian.

Potential Requirements for Non-Cleared Derivative Transactions. An issuer of securities registered under the Securities Act or reporting under the Exchange Act must obtain approval from the appropriate committee or board to enter into a swap that is exempt from mandatory clearing or exchange-trading requirements. Some companies have requested that this be required only on a one-time basis. In addition, a company that elects the exemption to not clear is required to:

- Provide information to the relevant commission as to how it meets its financial obligations with respect to non-cleared swaps.

- Report the methods it uses to mitigate the credit risk for these swaps such as the receipt of credit support (i.e., Credit Support Annex to ISDA), receipt of pledged or segregated assets, receipts of guarantees or appropriate reliance on counterparty’s other financial resources.

- Notify the relevant commission each time it uses the end user clearing exemption. Some companies have requested in their comments that it would be less burdensome to do this annually or some other less frequent periodic notification requirement.

- Provide the counterparty with evidence that it qualifies for end user exemption

- The transaction must be hedging an underlying exposure. According to the proposed rules a swap hedges a commercial risk if it:

- Qualifies as a hedge under the commodities exchange act, or

- Qualifies for hedging under the Financial Accounting Standards Board accounting standards, or

- Is economically appropriate to the reduction of the risk where the risk arises in the ordinary course of the business from a potential change in value of the assets, liabilities or services that a person provides or a potential change in value related to FX or a fluctuation in interest, currency or FX rate exposures arising from a person’s assets or liabilities.

Requirements for Cleared Derivative Transactions. If the end user elects to clear a swap it would enter into:

- Customer account agreement

- OTC addendum with a Futures Commission Merchant (FCM) which is a clearing member

- OTC give-up agreement with the FCM & Counterparty.

Different types of swaps may be executed and cleared on different platforms, impacting cross-product netting that is allowed in ISDA agreements. Also, entities have the right to choose the clearinghouse and custodian for the initial collateral to be posted.

Next Steps. As we move closer to the December deadline, affected entities should consider initiating a project to determine how they will proceed once the rules are finalized. Decisions must be made about the appropriate action steps, affording best protection and regulatory compliance, whether hedges are cleared or non-cleared. Listed below are steps one can take now: